Nippon Sanso Holdings expressed its support for the recommendations of the Task Force on Climate-related Financial

Disclosures (TCFD)*

in November 2019. We have already been working to reduce environmental impacts and save energy, and to expand its

lineup of products that contribute to reducing GHG emissions.

However, based on the

final recommendations of the TCFD, we will enhance these

initiatives even further and phase in improvements to our

relevant information disclosure as we work to increase the

corporate value of the entire Group.

※The TCFD announced its final recommendation report in June 2017, which recommends

that all companies and other organizations disclose information about governance,

strategies, risk management, indicators, and targets regarding climate change-related

risks and opportunities.

Governance

We have established a governance structure for

climate change issues, and we are engaged in

initiatives on climate change.

In November 2021, the Group established the Group Sustainability Management Office to promote general sustainability activities such as deliberation and formulation of climate change-related strategies and risks. We also established the position of Chief Sustainability Officer (CSO), and are working to coordinate closely with the Group Sustainability Management Office and communicate with each Group company. To enable more solid coordination and sharing of information, we established the Sustainable Development Committee in July 2023, and have assigned Regional CSOs to each region from April 2024.

Strategy

Regarding climate-related issues identified as materiality, we have

identified opportunities and risks through

"transition scenarios" and "physical climate scenarios" based on the TCFD's recommendations. Negative impacts that

have a significant financial impact on our company are considered as risks, while positive impacts are considered as

opportunities.

For the "Transition Scenario," the Sustainable Development Scenario(SDS) of the International Energy Agency(IEA)

was used, and for the "Physical Climate Scenario," Fifth Assessment Report (RCP8.5) of the UN's Intergovernmental

Panel on Climate Change(IPCC) was used as a reference for impact analysis.

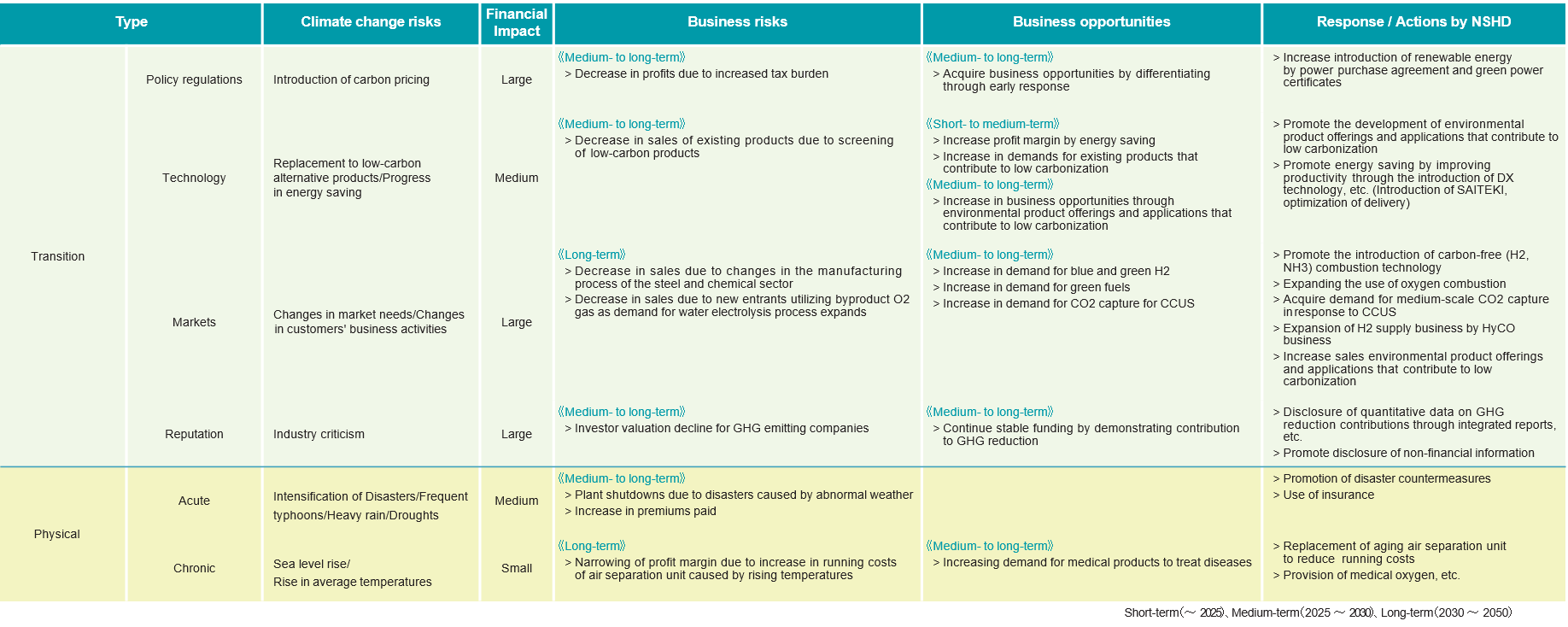

The table below shows the results of our analysis and synthesis of our group's opportunities and risks and their

possible impact on our procurement, operations, and products/services.

As a result of the evaluation, the following four opportunities and risks were deemed to be “large” or “medium,” and we conducted a quantitative calculation of the financial impacts on the Company’s business for each of them.

Details of Calculation Result

(1) <Risk> Introduction of carbon pricing: Decrease in profits due to increased tax burden

The NSHD Group aims to achieve carbon neutrality by 2050 and is working to reduce its greenhouse gas (GHG) emissions by 18% in FYE2026 and 32% in FYE2031 compared to the baseline year of FYE2019. The Group’s FYE2031 GHG emissions (Scope 1 and Scope 2) are projected at approximately 4.55 million tonnes. Based on the International Energy Agency (IEA)’s World Energy Outlook 2023 Net Zero Emissions (NZE) scenario, assuming a carbon price of approximately ¥13,000–20,000/t-CO2e (US$90–140/t-CO2e) for 2030, the amount of financial impact on the Group due to carbon pricing is estimated at ¥59.4–92.5 billion per year. Our initiatives to achieve further reductions of GHGs will include replacing ASUs, purchasing green energy certificates, and introducing renewable energy.

(2) <Risk> Change in customers’ business activities: Decrease in sales due to changes in the manufacturing process of existing customers in the steel and chemical sectors

Net sales of oxygen for blast furnace–basic oxygen furnace systems by the NSHD Group and its affiliates are estimated at about 5% of the Group’s consolidated net sales (approximately ¥60.0 billion). Considering fluctuations in oxygen demand in the steel sector based on the outlook for steel production by manufacturing method in the IEA’s Energy Technology Perspectives 2020 Sustainable Development Scenario, the net sales of oxygen for blast furnace–basic oxygen furnace systems by the Group and its affiliates in 2050 is estimated at ¥30.0 billion (about ¥30.0 billion less). The steel sector will continue to use oxygen in electric arc furnace and direct reduction ironmaking, which are expected to see an increase in demand going forward, and we will capture these demands.

(3) <Risk> Intensification of disasters: Plant shutdowns due to disasters caused by abnormal weather

Using the Aqueduct Floods simulation by the World Resources Institute, we confirmed the estimated damage to the NSHD Group’s 130 main production sites from the impact of a 100-year flood under the 4°C scenario for 2050. At 17 sites in Japan and overseas, inundation damage of 0.1 m or higher was forecast. Referring to the Manual for Economic Evaluation of Flood Control Investment (Draft) April 2020 edition produced by the Ministry of Land, Infrastructure, Transport and Tourism, we estimated the amount of damage at each site using the formulas for calculating sales opportunity loss (loss due to suspension of operations) and the loss impact on inventory and equipment (depreciable assets) based on the inundation depth. Through this calculation, we estimated the damage for a 100-year flood across all sites to be approximately ¥36.0 billion in total. We have also calculated that applying our current disaster insurance policies can reduce the damage to approximately ¥18.0 billion. Looking at the flood damage risk that we have recognized under the 4°C scenario, we have identified the potential for inundation of major production sites as a material risk. We will continue working on measures such as promoting disaster countermeasures and utilizing disaster insurance.

(4) <Opportunity> Changing market needs: Expansion of blue/green hydrogen demand

According to the IEA’s “Net Zero Emissions by 2050 (2023 Update),” demand for low-emission hydrogen, such as blue and green hydrogen, is expected to expand, mainly from 2030 onward, increasing from 70 Mt-H2 in 2030 to 420 Mt-H2 in 2050. In addition, the IEA’s NZE scenario indicates a range of manufacturing costs for blue and green hydrogen. The combined estimated market for both types together is expected to be ¥13–41 trillion in 2030 and ¥60–218 trillion in 2050. We will continue to expand our hydrogen supply business through the HyCO business to exploit the opportunity presented by the transition to a decarbonized society.

Risk Management

We will construct a Groupwide risk management structure, and will identify, assess, and manage climate-related

risks.

Climate change risk identification, assessment, and management process

|

Risk identification, assessment, and management |

• Global Risk Management Committee

• Global Strategy Review Committee

• Technology Risk Liaison Committee |

• Construction of risk management system in Nippon Sanso Holdings Group companies to

enable early

discovery of long-term risk, prevention, and rapid response in cases of risk materialization

• Risk importance determined by occurrence frequency × Financial or strategic impact

• Annual Global Strategy Review Committee meeting (Chairperson: CEO) to determine financial or

strategic impact on business

• Specific countermeasures for items determined by the Global Strategy Review Committee determined

at Technology Risk Liaison Committee meeting held between Nippon Sanso Holdings and operating

companies, then deployed globally

•The Global Risk Management Committee (chaired by the CEO) meets once a year. The committee identifies and evaluates risks from the perspectives of recognizing changes in the business environment and both the increase and impairment of corporate value, and selects material risks

|

Metrics (Indicators) and Targets

In the medium-term management plan, we will set out indicators and targets to be used for assessing and managing

risks and

opportunities, then use them to evaluate our progress.

Moreover, in order to further promote responses to climate change, Nippon Sanso Holdings introduced internal carbon pricing, one of seven cross-industry metrics, in April 2024 to be used as an indicator when making investment decisions.

| Initiatives |

Disclosed details |

| We disclose Scope 1, Scope 2, and Scope 3 GHG emissions |

• Sustainability data

• Third-party assurance report

|

| We disclose Non-Financial KPI in the Medium-term management plan |

• Eight Non-Financial

Programs

|

| Introduction of internal carbon pricing for Scope 1 and Scope 2 (shadow pricing) [From April 2024] |

• Operating price (NSHD integrated): US$85/t-CO2 |